A few weeks ago, a potential customer of ours asked “What makes us different from other trading styles?”. In particular, she mentioned that her husband had followed trading blogs and podcasts before where the individual would call out trades and provide examples of good trade setups. This video blog was done to try and answer that question. I started by performing a google search for MACD Trading Strategy. I found a strategy that someone was recommending, coded it up and analyzed it using Quantitative Analysis. I present my initial findings in this first in a series of two video blogs analyzing a common Moving Average Convergence Divergence Trading Strategy.

MACD Swing Trading Strategy Idea to Review

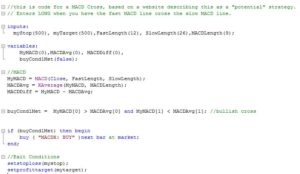

This idea came from a google search of MACD Trading Strategy. Here is a snap shot of what was recommended, taken directly from his website:

MACD Moving Average Bullish Cross Swing Trading Strategy Implementation

This strategy was simple enough to implement using Easy Language code. I took the authors example and used 60 minute candles. In addition, I took the liberty to constrain the session times to be from 9:30 AM EST – 5:00 PM EST, restricting trades to be placed only when the equity markets are open + 1 hour. I analyzed this trading strategy for the S&P 500 Emini (ES).

The strategy mentioned on the website didn’t mention when to exit, so I took the liberty to add a stop market order and a target (limit) order – initially of $500 for both the stop and limit.

MACD Swing Trading Strategy Initial Analysis

Here is an example of a winning trade this MACD swing trading strategy showed. The trades placed in November 2016 showed tremendous promise. Perhaps the author of this strategy is onto something? Could it be this simple – to essentially use a bullish cross of the MACD to create an algorithmic trade setup?

MACD Swing Trading Strategy Final Analysis

Curious how this strategy did during the entire back-tested period? What happens if you modify the limit order? What if you schmoo the stop market order and do an exhaustive test from any stop beginning at $200 all the way up to $800? Watch the complete video for answers to these questions an more. You might be surprised at our findings.

Thanks for watching! Remember, trading futures & options involves substantial risk of loss and is not appropriate for all investors.