A Robust Design Methodology

Our design methodology begins with an idea that is coded, analyzed, back-tested, optimized, and then undergoes walk forward analysis (WFA). This lengthy process is only the beginning. Any strategy which passes these initial steps is further analyzed to determine their hero & villain states. Multiple trading strategies will be combined to form a complete Trading System such as Geronimo or Phoenix. As you review our algorithmic trading strategy, please consider the risks involved prior to utilizing our algorithmic trading strategies. Trading futures & options carry a significant risk of loss and are not appropriate to all investors.

Phase 1: Trading Strategy Design Methodology

This video, presented by our lead developer – covers in great detail the process we use to develop an individual trading strategy or trading algorithm.

Phase 2: Combining Trading Strategies to Form a Complete Trading System

This video, presented by our lead developer – covers in great detail the process we use to form a robust Trading System consisting of multiple uncorrelated Trading Algorithms.

Is This Trading Strategy Perfect?

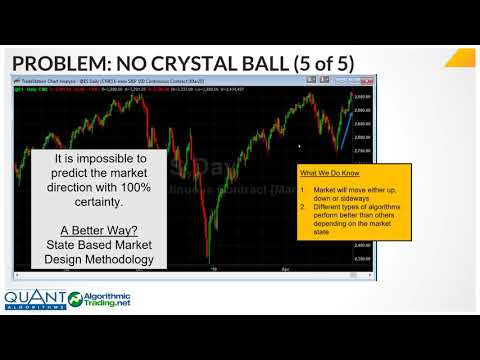

It is the opinion of AlgorithmicTrading.net, that no holy grail of trading exists and that there is no such things as a perfect trading strategy. All strategies have flaws and until someone designs a crystal ball – there will be stress & emotions involved with trading. With that said, it is our experience that this kind of trading methodology – grounded in actual quantitative analysis (not talking heads or loud trading rooms), provides a sense of emotional relief when it comes to active trading.

As all traders know, trading is very difficult and emotions can cause us all to do irrational things. Our experience is that some of the most stressful trades are ones that go well. Its human nature to want to lock in profits – but traders are all to familiar with getting out too early and watching the market continue higher. They jump back in, wanting to capture more gains only to see the market reverse. They hold onto the loser way too long and end up taking a larger loss than anticipated after moving their stops. This process repeats itself and is one reason why many day traders fail.

While our methodology is not perfect – we do take losing trades, losing months and even losing quarters, by trading multiple strategies we minimize a certain type of fear that most traders face, namely the fear of “getting the market direction” wrong. The data does show us that even with our trading methodology, the market can go higher and the best performing “bull market” trading strategy we have (Momentum ES Trading Strategy) can still take losses during its Hero Market State.

As mentioned repeatedly, trading futures and options is not for everyone. You should only trade with Risk Capital. If you are in doubt, discuss our algorithmic trading strategies with a registered CTA or Investment Advisor. As a third party trading system developer, we are not registered with the NFA as Commodity Trading Advisors (claim the self-execution exemption from registration) and can not provide investment advice unique to your personal situation.