ARE YOU READY TO LEARN ACTUAL STRATEGIES BACKED BY A QUANTITATIVE DESIGN METHODOLOGY?

Are you tired of courses that are full of opinions and lacking in data? Look no further than our “Trading with the Odds”, five-part video series. This is the first class of five, covering the MACD. It includes video lectures, homework, quizzes and includes a hard copy Technical Traders Toolkit.

Watch the following video for an overview of what we are offering.

Ready to Sign Up for MACD: Trading with the Odds?

INCLUDED IN EVERY COURSE

Each course is professionally designed to teach you multiple skills depending on your intent. These self-guided courses are intended to become part of a larger skillset that you will develop over time. Our pilot class, MACD Trading with the Odds is designed to teach you the basic methodology we use to develop the algorithms we use. In the process of learning, you will see firsthand how some ideas work, and others need some work. Our methodology helps guide traders through this process with the final output being one strategy that uses the MACD and passed our Algo Grader with at least an 80% score.

VIDEO LECTURES

ASSIGNMENTS

QUIZZES

Most sessions also include a pass/fail quiz designed to ensure you are ready to proceed to the next video. This is done to ensure you pick up on the key points being taught in the lecture portion.

Heres What You Get Access To With Each Class

Step-by-step videos

Hard Copy Binder with Technical Traders Toolkit

Course notes and strategy flashcards

Practice trade setups

Strategy performance reports (2001-2021)

Access on any device

Study at your own pace

Test your learning with interactive sections

Download the code for use with TradeStation [OPTIONAL]

Learn how best to use the MACD indicator

INCLUDES THE TECHNICAL TRADERS TOOLKIT

As you progress through our classes, you will be collecting certain skills, designed to walk you through a completely methodical design process. From initial idea to a fully optimized and back-tested trading system. This also includes mailing you a hard copy of the Technical Traders Toolkit in binder format. As you take more classes, you can add them to your toolkit. The toolkit has sections for notes, homework, a summary of the lectures and single page format, description of any strategies that pass the AlgoGrader with an 80% or higher. Finally, the binder includes a section for the tips acquired.

SESSION OUTLINE

Each class has multiple sessions. You will at all times know where you are in the learning process as the videos and coursework reference the Session Outline (included in your Technical Traders Toolkit). Each class has an informational session, followed by a strategy session and then a tips session. Each session consists of multiple video lectures.

SECTION NOTES

As you progress through each section, you will have a hard copy of the key points from each section with space for your notes. Notes also include areas to complete the assigned homework.

STRATEGY REFERENCE

Each class provides at a minimum one strategy that has passed our Algo Grader Standard. This strategy is graded and a Reference Sheet is provided in the Toolkit. The strategy provides exact chart setup and trade information.

TIP SHEET

A Tip Sheet is also provided for each class offered. The tip sheet provides a list of best practices for the indicator being examined. Tips are explained in detail in each class, you will see for yourself the methodology we use to determine the tips we provide.

Session OutlineEXAMPLE

NotesEXAMPLE

StrategyEXAMPLE

Tips & Best PracticesEXAMPLE

Ready to Sign Up for MACD: Trading with the Odds?

Get Started Now for $750

CLASS OVERVIEW

Trading with the Odds: MACD

This is our introductory “Trading with the Odds” class. It consists of 8+ hours of video lectures dispersed across 4 different sections. Each section has multiple lectures, homework, quizzes, and downloads. Our students progress through the self-guided course at their own pace. This class is the first component of any individual’s Technical Traders Toolkit. As you take more classes, your toolkit will grow as you acquire more and more tools/skills.

01 WHAT IS THE MACD?

The purpose of this section is to provide a detailed look at the Moving Average Convergence Divergence (MACD). You will not only know what it is but also what different events are telling you.

TOPICS COVERED

This section provides a close look at the MACD. and how it’s used. You will closely examine the different components of the MACD to include the signal line and histogram.

- Explanation of MACD

- TExplanation of MACD Signal Line and Histogram

- Interpreting MACD Events

- Common Uses for MACD

SKILLS ACQUIRED

Introductory View of the MACD Technical Indicator

Introductory View of the Different MACD Events and What They Suggest

Introductory Level View of how the MACD is Used

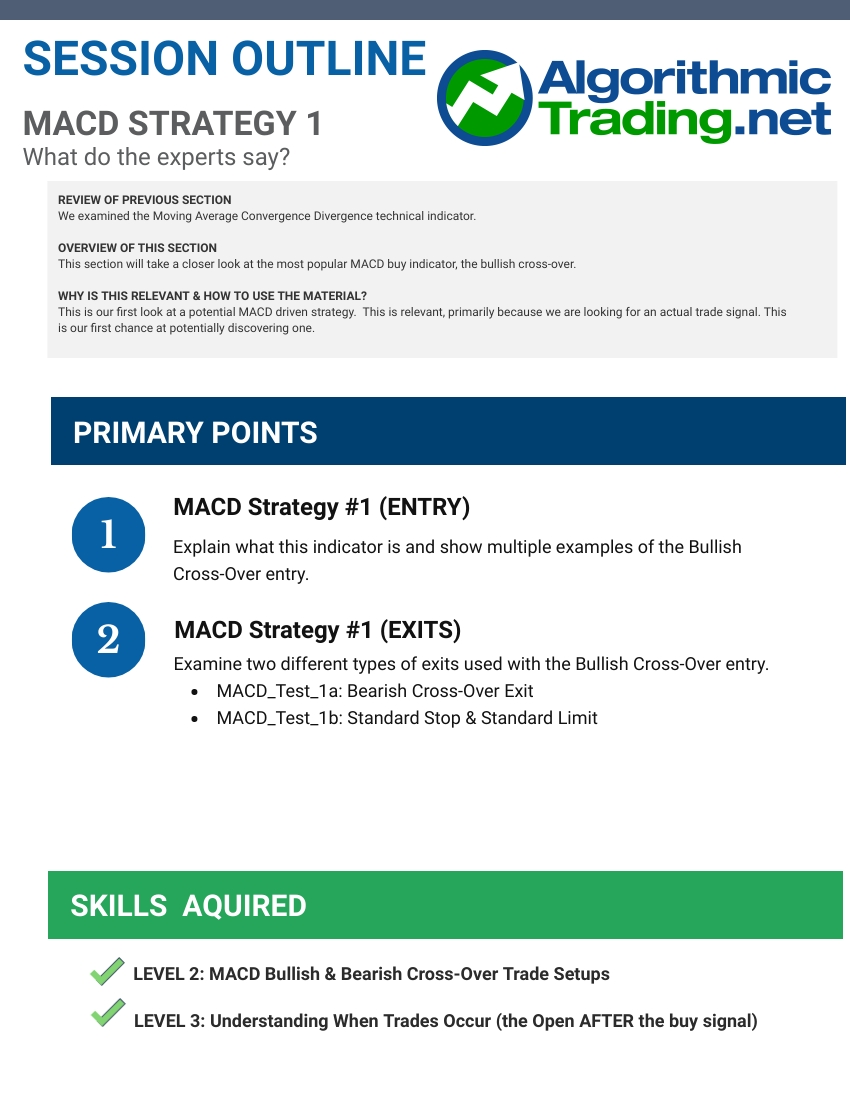

02 MACD STRATEGY #1

This section covers the first strategy we will examine as it pertains to the MACD. Part One looks at the strategy itself while Part Two looks at the results and runs each strategy through the AlgoGrader to determine if it is a strategy that should be used.

PART 1

MACD CROSSOVER STRATEGIES

TOPICS COVERED

The focus of section 1 is to look at the Bullish Cross strategy along with a bearish cross for the exit as well as a standard stop/limit.

In this video lecture, we will look at multiple examples of this trade occurring. You will become very familiar with identifying these strategies trade setups.

- Close Look at Bullish Crossover Strategies

- TDetailed Look at Bearish Crossover Exit

- NAdding a Standard Stop & Limit

SKILLS ACQUIRED

MACD Bullish & Bearish Crossover Trade Setups

Understanding When Trades Occur

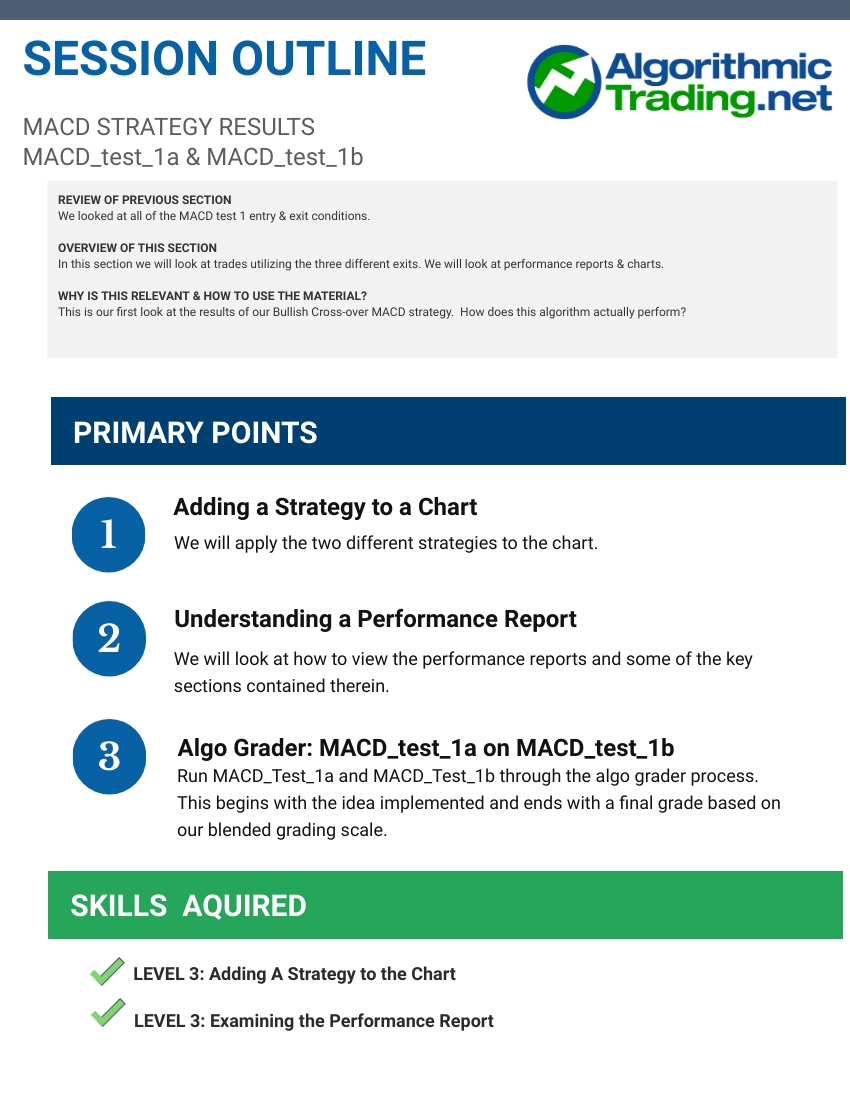

PART 2

MACD CROSSOVER STRATEGY RESULTS

TOPICS COVERED

This section takes a close look at how you evaluate a trading system. We look closely at the two Bullish Crossover strategies (1A & 1B), applying the AlgoGrader methodology to evaluate each strategy with complete objectivity.

- How to Generate a Performance Report

- Key Metrics on Performance Report

- How to Use the AlgoGrader

- Final Grade/Report for MACD Strategy 1A

- Final Grade/Report for MACD Strategy 1B

SKILLS ACQUIRED

Adding a Strategy onto a Chart

Examining a Performance Report

03 MACD STRATEGY #2

This section covers the second MACD strategy. Part One looks at the principle ideas behind the strategy, while Part Two and Three looks at two distinct implementations of this strategy and their results.

PART 1

MACD DIVERGENCE STRATEGIES

TOPICS COVERED

In this section, we take a second look at the MACD using a bullish divergence as a potential entry condition. We investigate why the indicator shows so much potential and look at potential trades.

- Close Look at Bullish Divergence Strategies

- TDetailed Look at Bearish Divergence Exit

- Adding a Standard Stop & Limit

- Explanation of a Strength Variable

SKILLS ACQUIRED

MACD Bullish & Bearish Divergence Strategies

Using Strength Variables to Modify Entry & Exit Logic

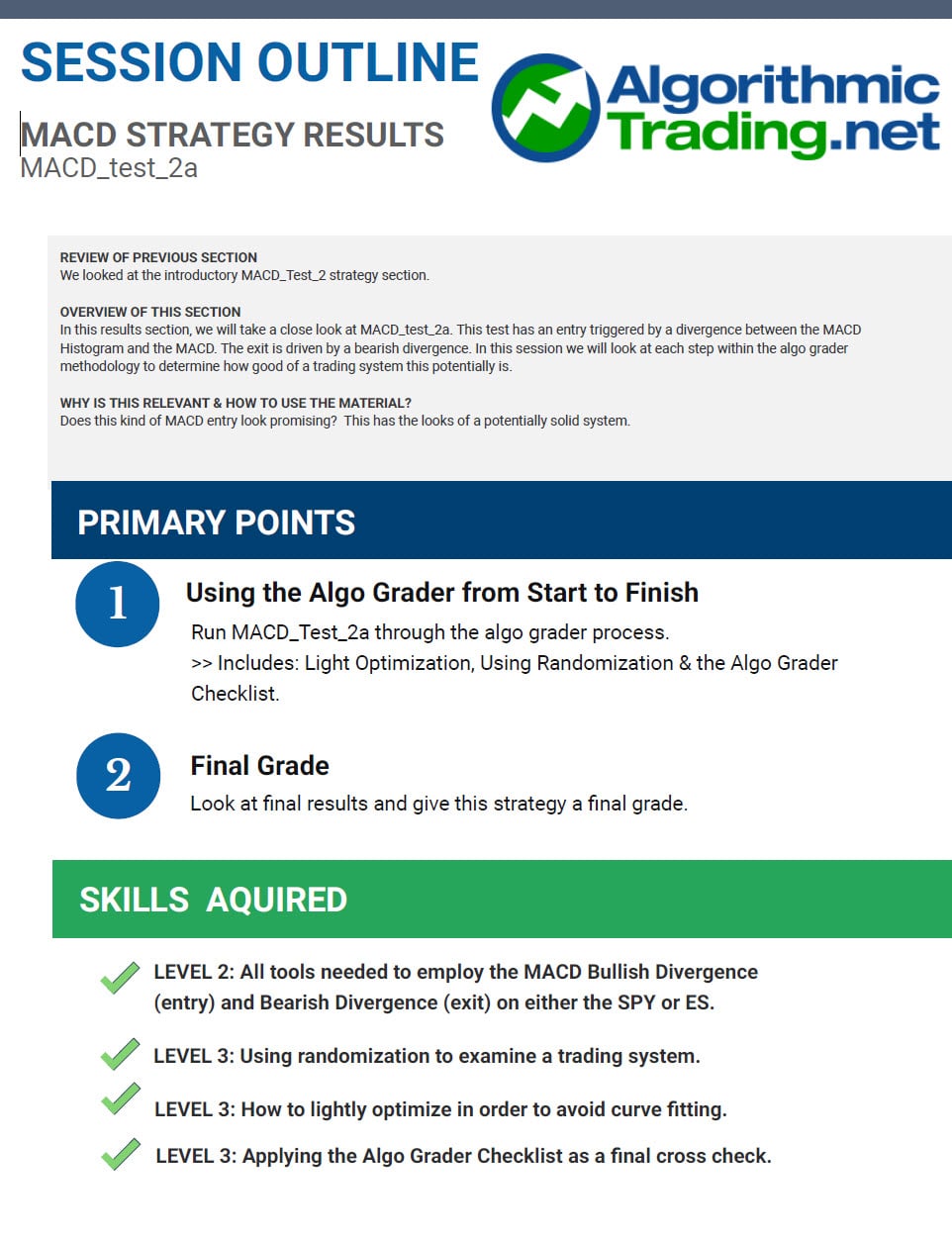

PART 2

MACD DIVERGENCE STRATEGY (2A) RESULTS

TOPICS COVERED

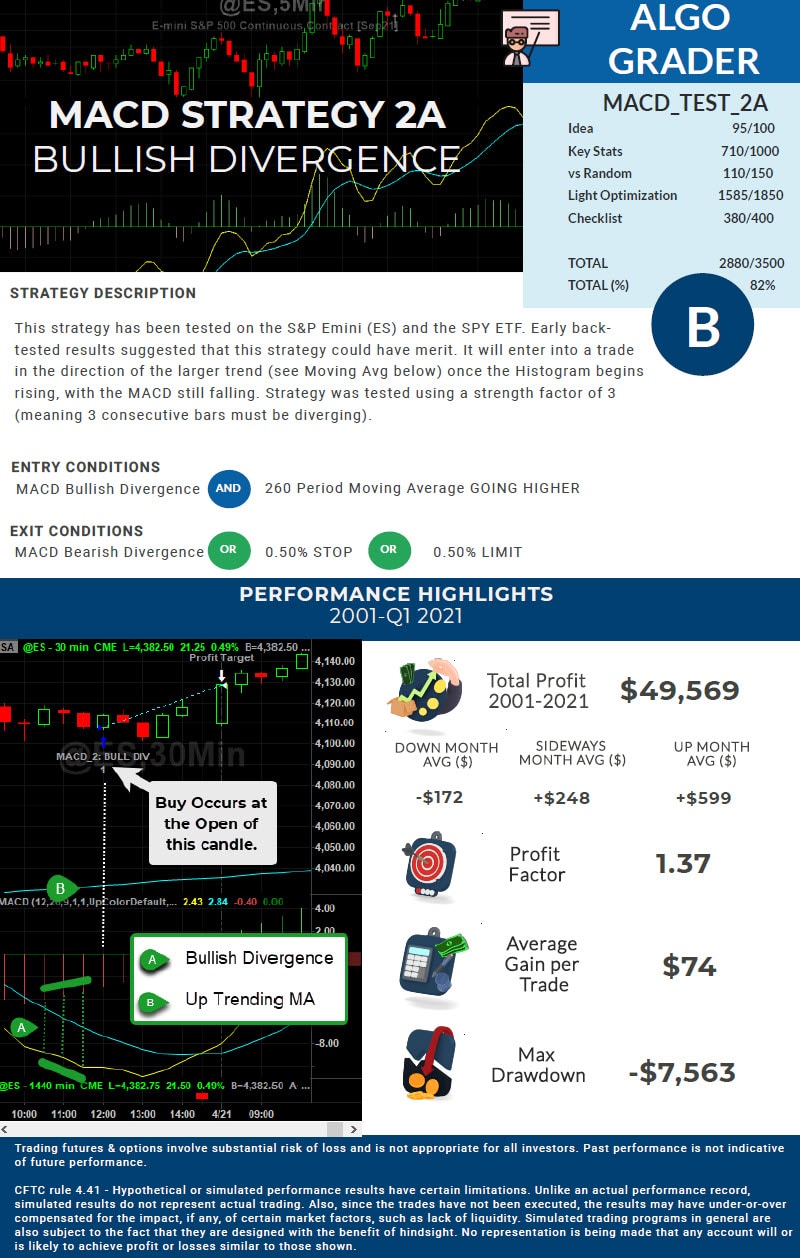

This section looks at a strategy that shows promise and provides an example of how you walk through an entire grading process from start to finish, with the final result being an actual strategy that can be used (MACD_Strategy_2A).

- TReview the Idea

- Evaluating the Algorithms Performance Report

- Comparing the Results vs. Random Data

- Run a Light Optimization

- NFinal Checklist Confirmation

- Final Grade Given for MACD Strategy 2A

SKILLS ACQUIRED

All Tools Needed to Employ the Bullish Divergence Entry & Exit (SPY & ES)

Using Randomization to Test a Trading System

How to Lightly Optimize in Order to Avoid Curve Fitting

Utilizing the Algo Grader as a Final Checklist

COMPLETE STRATEGY+INCLUDED WITH THE TECHNICAL TRADERS TOOLKIT

Part of this section includes walking you through the development of a strategy from beginning to end, from being a simple idea to a fully optimized trading system. You will have the exact chart settings, know the precise entry signal, and the optimized stop & limit to use. In addition, you will have access to the TradeStation performance report. Access to this strategy alone is worth the cost of the class.

PART 3

MACD DIVERGENCE STRATEGY (2B) RESULTS

TOPICS COVERED

To complete our analysis of the MACD Divergence signal, we look at different exit strategies to ensure we have the best configuration possible. We run a back-test of the Stop & Limit but use the same entry signal. This represents MACD_Test_2B and concludes our analysis.

- Optimizing to Determine Stops & Limits

- TLimitations in Testing & Data

- QFinal Grade/Report for MACD_Strategy_2B

SKILLS ACQUIRED

How to Optimize a set of Inputs (STOP/LIMIT)

Understanding the Constraints of Limited Cycles

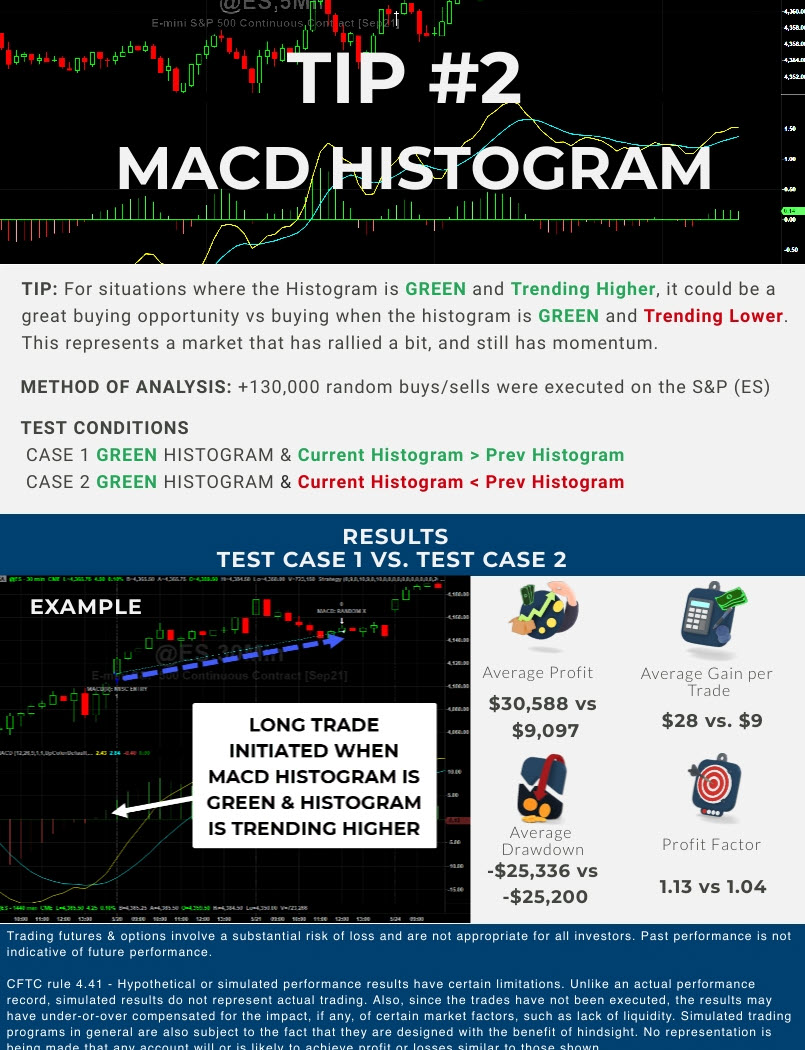

04 MACD TIPS & BEST PRACTICES

The purpose of this section is to provide a list of best practices for using the MACD, backed by the data seen using our Algo Design Methodology.

TOPICS COVERED

This section provides a detailed explanation of how we answer the questions posed, such as “Is it better to buy into momentum or wait for a pullback?”. These questions are answered using a fully algorithmic design methodology. There are no “opinions”, our tips are backed by data in full transparency. Tips are provided so that you can implement their principles in your own strategies.

- How Tips Differ from Strategies

- Demonstrate Methodology for Tip Generation

- uTip #1: Buy Momentum vs. Catch a Falling Knife

- uTip #2: Buy Momentum vs. Buying Pullback

SKILLS ACQUIRED

Red Histogram Tips & Best Practices

Green Histogram Tips & Best Practices

Our Methodology for Developing Tips

TWO DATA DRIVEN TIPS+INCLUDED WITH THE TECHNICAL TRADERS TOOLKIT

Part of this section includes providing you with tips for using the MACD, also referred to as best practices. These tips are determined through a transparent and fully mechanical approach. They are provided for the trader who prefers to develop his own strategies and needs some best practices, backed up by data to help make trading decisions.

One way traders can utilize tips is to use their own strategy, but allow for the MACD Tips to confirm the intended trade. Stacking the odds in your favor is the purpose of tips.

Ready to Sign Up for MACD: Trading with the Odds?

Get Started Now for $750

CONTINUE COLLECTING SKILLS AS YOU COMPLETE ADDITIONAL CLASSES

TOOLBOX

ALGO GRADER

Each strategy (good and bad) will go through our Algo Grader test. It will be graded and you will have access to its strengths and weaknesses. If we say a strategy is good, you’ll know all the reasons why.

SKILLS BROKEN DOWN BY LEVEL

Whether you are simply curious about trading, what to become a technical trader, or rise to the level of full-blown Quantitative Trader, each class will identify the new skills you will acquire.

CLASSES DESIGNED BY AN ENGINEER

Avoiding opinions is key for any trading class. Our tips & strategies are backed by the data in full transparency.

LEARN ACTUAL STRATEGIES

Most classes simply give you the same information, regurgitated in a slightly different way. Our quantitative approach is designed to cut through the “basic strategies” you find online and provide actual strategies backed up with Quantitative Analysis. The back-tested reports provide the grounding for the algorithm in question.

AUTOTRADED STRATEGIES

If you prefer to have the strategies taught in this class auto traded, then for an additional fee there are NFA registered brokers ready to support this.

REQUEST MORE INFORMATION

Simply fill out this form and be sure to include any questions you might have related to the classes we offer. We will provide you with pricing information and the relevant sign-up links.

Ready to Sign Up for MACD: Trading with the Odds?

Get Started Now for $750