S&P CRUSHER: Not Available to New Clients *

Past performance is not indicative of future performance. Trading futures & options is not for everyone and involves substantial risk of loss.

PRODUCT DASHBOARD: S&P CRUSHER WALK-FORWARD/LIVE

The following information was taken from actual statements trading the S&P Crusher since February 2017. While performing your due diligence, keep in mind that we are not registered Commodity Trading Advisers (CTA) and therefore this data has not been reviewed by any government agency such as the CFTC. These results include per trade commission charged by the broker, however they do not take into account the license fee AlgorithmicTrading.net charges for the use of their algorithms.

PRODUCT DASHBOARD: S&P CRUSHER BACK-TESTED

The following information was taken from back-tested reports provided by tradestation. Back-tested models are typically the most optimistic model a developer can provide. While they do have the benefit of hindsight, they can still be helpful in gauging the “best case” potential of a system and to provide a type of benchmark to compare live returns with. It is for these two reasons we have decided to continue providing the back-tested stats for each trading system.

| Performance Analysis | |

| Annual % Rate of Return | +41.45% |

| Monthly % Rate of Return | +3.45% |

| Avg $ Gain/Mo | +$1,036 |

| Total # Trades | 2173 |

| Period Analyzed | Jan 2003 – Jan 2017 |

| Per Trade Win Rate | 68.98% |

| Slippage/Commission Used in Analysis | |

| Commission used in all reports (Futures Trade) | $6.50 per round trip trade (all-in) |

| Slippage used in all reports (ES) | $12.50 per round trip trade |

| Slippage used in all reports (TY) | $24.00 per round trip trade |

| Draw-Down (per UNIT traded) | |

| Worst $ draw-down (closing trade to closing trade) | -$8,640* |

| Worst % draw-down (closing trade to closing trade) | -29.25%* |

| Date Seen | Jul 2005 – Mar 2006 |

| Account Details | |

| Per Unit Trade Size | $30,000 |

| Instrument traded | ES/TY |

| Trades Futures | Yes |

| Account types allowed | Cash, IRA, Roth IRA |

| Licenses available | Yes |

| Licensing fee | Contact Us for Pricing |

*Estimated closing trade to closing trade draw-down based on back-tested period (see CFTC disclaimer, below). Note that heavier losses than indicated are possible. Maximum Draw down can be used to determine the measure of risk involved with any given trading system. It represents the maximum peak to valley loss seen on the account during the back-tested period.

CFTC RULE 4.41: Results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown. Trading futures involves substantial risk of loss and is not appropriate for all investors.

S&P CRUSHER FEATURES

LOWEST DRAW-DOWN COMPARED TO OUR OTHER SYSTEMS

100% AUTOMATED SYSTEM

TRADES IN BULL & BEAR MARKETS

POSITIVE ONLINE REPUTATION

HOW DOES THE S&P CRUSHER STACK UP?

Why would anyone prefer this algorithm over the other ones you offer?

- It has the lowest draw-down (on a percent basis)

- It has traded live since February 2017 (long track record)

Past performance is not indicative of future performance.

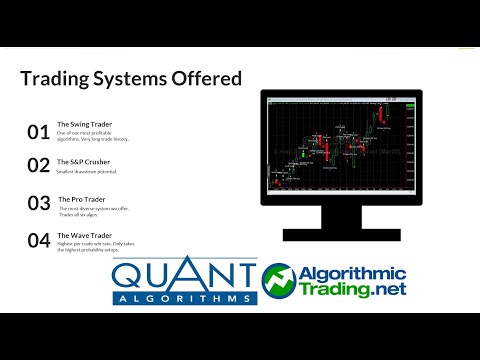

This video provides a detailed look at all four of our trading systems.

KEEP UP TO DATE ON ALL TRADES

Using the OEC iBroker app you are able to receive push notifications when we get into a new trade, see limit and stop market orders, charts of the S&P Emini and Ten Year Note, plus current account balance and much more. Select brokers utilize the OEC iBroker App (iPhone and Android), ask us for more details.