- 6.81% Avg Per Month (LIVE)

- Automated Trading System

- $15,000 Unit Size

- S&P E-Mini Long & Short

- 77% Profitable Months

Is it Really Possible for an Algorithmic Trading System to Generate 6.81% Per Month in Live Trading?

Watch this video and see for yourself. Clients trading the Trader+ on auto-pilot have done just that. No experience is needed, all customers utilizing the Trader+ saw similar returns.

DISCLAIMER

U.S. Government Required Disclaimer – Commodity Futures, Trading Commission Futures, Derivatives and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This website is neither a solicitation nor an offer to Buy/Sell futures, options, or any other assets. The past performance of any trading system or methodology is not necessarily indicative of future results.

Start Auto-Trading Today With The Trader+

WHAT IS THE TRADER+ TRADING SYSTEM?

This is a fully automated trading system that trades through multiple NFA registered brokers. Watch the following video for a brief introduction to the Trader+ Trading System.

Past performance is not indicative of future performance. Trading futures involves substantial risk of loss and is not appropriate for all investors.

DID THIS SYSTEM REALLY MAKE 19.50% IN ONE DAY?

Yes it did. The following video (from 8/15/2024) shows two trades as they happened in real time along with some commentary from our lead developer. These trades bought the S&P Emini on a momentum trade which resulted in profits of $2,925 per $15,000 traded.

This system is capable of having days like this. Don’t miss out on the next one we have! Keep in mind too, we do have losing trades and losing months. However this video shows the potential of this trading system to give above average returns while minimizing risk.

SIX REASONS TO CONSIDER USING THE TRADER+

Here are six different reasons why someone might choose to use the Trader+ trading system. One of the more compelling reasons is for the potential of rapid account growth but another reason might be for cash flow generation, or perhaps you are just exhausted from worrying about your own trades. An automated, or fully algorithmic trading system can really help you get the break and rest you need.

REASON 1: Live Returns of 6.81% Per Month

There are lots of trading systems being offered that show back-tested or simulated returns. The Trader+ has been trading live for over nine months and our returns have been pretty spectacular. Of course, past performance is not indicative of future performance. Trading futures involves substantial risk of loss and is not appropriate for all investors.

REASON 2: Back-Tested as Far Back as 1997

We have back-tested this trading system as exhaustively as we can. This includes back-testing all the way back to 1997. This is as far back as we can go, if we could test it further we would. What this data shows, is that this strategy performs well in up, down and sideways trending markets.

REASON 3: Remove Your Emotions from Trading

No more staring at charts, no more letting your emotions get in the way of your performance. If you are tired of the emotional swings (highs & lows) then using one of our trading systems could be the break you have been looking for.

REASON 4: Places Multiple Different Kinds of Trades

The Trader+ utilizes advanced market prediction algorithms to take advantage of multiple different opportunities as they are presented. Live returns have confirmed this, in fact Aug-Sep-Oct 2023 was a very bearish period in US Equity markets, meanwhile the Trader+ delivered some of its best returns ever in that same period of time.

REASON 5: Fully Automated

The Trader+ is a robotic or black-box trading system. It trades on full auto-pilot, being monitored by the NFA Registered broker of your choice (multiple you can pick from). No experience is needed, the algorithms trade day by day, without any emotions being involved.

REASON 6: Reduce Overnight Risk

The Trader+ will not hold overnight. It will exit its day-trades by 4PM ET. This can reduce risk substantially, since we are in cash when the market is closed.

DISCLAIMER

U.S. Government Required Disclaimer – Commodity Futures, Trading Commission Futures, Derivatives and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This website is neither a solicitation nor an offer to Buy/Sell futures, options, or any other assets. The past performance of any trading system or methodology is not necessarily indicative of future results.

EXAMPLE OF A SHORT TRADE AS IT WAS RECORDED IN REAL TIME

Periodically, our lead developer will record trades as they happen in real time. Watch this video where you see the Trader+ trigger a short trade and make a nice profit of about $1,378 per unit traded. WIth a $15,000 unit size, that’s a gain of approximately of 9.18%.

ADDITIONAL TRADE VIDEOS

The following playlist highlights all the different trades that were recorded in real time. Keep in mind, these videos do show the algorithms in a very positive light. In case its not obvious, we do have losing trades as well. These are meant to show our users (and existing clients) a closer look at the types of trades we place.

DISCLAIMER

U.S. Government Required Disclaimer – Commodity Futures, Trading Commission Futures, Derivatives and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This website is neither a solicitation nor an offer to Buy/Sell futures, options, or any other assets. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41: Results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

KEEP UP TO DATE ON ALL TRADES

Using the OEC iBroker app you are able to receive push notifications when we get into a new trade, see limit and stop market orders, charts of the S&P Emini, plus current account balance and much more. Select brokers utilize the OEC iBroker App (iPhone and Android), ask us for more details.

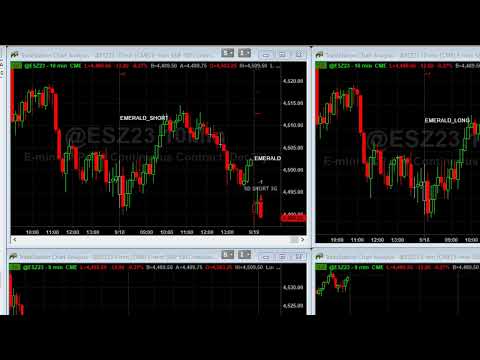

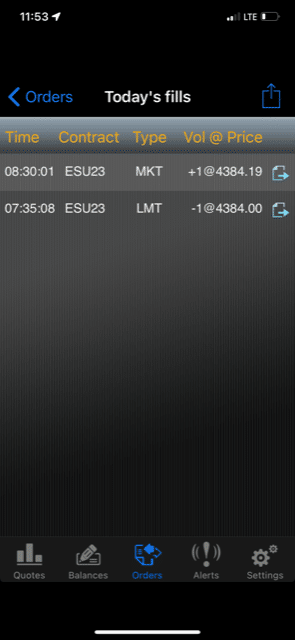

The following images are taken directly from a screen shot of an actual account trading our algorithms. Among other things, you’ll see the charting for the S&P Emini (including stops/limits), current trade information, fills and open orders and account balances. When a new trade is issued, the app can be configured to deliver a push notification so you know that you are in a trade.

CHARTS

Clients have access to multiple charting features on their smart phone.

TRADE INFO

Once we are in a trade, you will see the profit/loss, current days volume, last price and so much more.

FILLS & OPEN ORDERS

View all the days trades, open orders, closed orders and many other order related features.

ACCOUNT INFORMATION

At all times, you will be able to see your Open Profit/Loss, Realized Profit/Loss & Cash Available.