Trading System Design & Coding Services

Click Here to Give us a Review!

Specializing In Algorithmic Trading Design Architecture & Implementation

Our team is capable of implementing your idea in Easy Language for use in automated trading on platforms such as Tradestation. We have designed and implemented over 300 trading strategies and is our number one core competency. We are a software development company with a heart for implementing trading systems. If you have an idea or project – we might be able to help you implement this idea.

Logic Design Experience Includes

Our team has experience coding in Perl, VHDL, Verilog, C, C++, Java, Matlab, TCL/TK and Easy Language. In our experience, utilizing tradestations Easy Language is the best option for most retail traders. This language is capable of object oriented programming and has numerous predefined functions that make implementing most trading strategies quite simple. Our lead designer has designed DMA’s, PCI-Express Layers, Snoop Logic and more. While implementing a trading system is quite a bit different than coding a block of logic, there are numerous similarities. For example, in a block of synchronous logic running in an asic, new events happen on each clock cycle. In trading, events typically occur when a new candle is created on a chart. Logic design engineers are well versed in Finite State Machines and commonly used data structures which can be used in trading systems.

Quantitative Trading Experience Includes

AlgorithmicTrading.net is capable of coding your design, performing a back-test, running optimizations and cross optimizing inputs, monte carlo simulations and performing walk-forward analysis on out-of-sample data. In many ways, coding the design is the easy part. Much of the post coding tasks center around verifying the idea by back-testing it first, second optimizing it and third running a walk-forward analysis on out of sample data.

Depending on your budget and needs, AlgorithmicTrading.net will run all of the above tests and provide reports and commentary on each stage of the analysis.

Your Idea Implemented

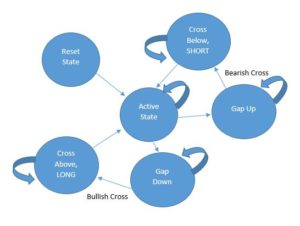

If your trading idea relies on a sequence of events, we will more than likely implement your trading system using a finite state machine in order to simplify the code. For example, perhaps your strategy waits for a gap up when the equity markets open, followed by a bearish cross on a MACD. Once this happens your strategy goes SHORT the market. The BUY occurs when you have a gap up followed by a bullish cross. The following bubble diagram shows what your state machine might look like.

Step 1: Fill Out Our Questionnaire & NDA

Give us a call or shoot us an email and we can send you our questionnaire. This form allows us to provide a quote to you based on the complexity of your idea. We might exchange a few emails and/or schedule a phone call to clarify your intent. If needed, AlgorithmicTrading.net will sign a Non Disclosure Agreement prior to you emailing us the filled out questionnaire.

Step 2: Receive A Quote

Based on the complexity of the design, our Lead Designer will provide an estimate of time involved and a quote. If you are satisfied with the price and expectations are clear we will move forward with the design. You will provide a non-refundable down-payment of 50% and the balance will be due once the design is completed. Included in the price is up-to 2 hours of modifications post installation to ensure that the code is working as you expected.

Step 3: Implementation Phase

Our designer will be in close contact with you throughout the coding and design phase to ensure that the architecture and implementation is consistent with your idea. This is done to avoid any surprises once the code is complete.

Step 4: Analysis Phase (optional)

Depending on your needs as identified in the questionnaire, we will back-test the trading system, run optimizations on the inputs, cross-optimize the inputs and run a matrix of walk-forward tests with varying in-sample and out of sample periods. At each phase of this process, we will provide reports on our findings so that you are kept in the loop.

Step 5: Design Hand-Off & Installation

Once the design is completed, the designer will schedule a time to perform the installation. The remaining balance is due prior to the design hand-off. During the installation, the designer will remotely login to your PC and install the Easy Language code onto your Tradestation platform. This usually takes less than an hour. The designer will review the code with you and show you how to adjust the inputs and other settings.

Step 6: Maintenance Phase

After the code is loaded and running, you might require a few changes to it. Included in the quote is up to 2 hours of post installation coding. In our experience, once the customer has the code running they might require a few modifications or bug fixes. This is extra time is included to ensure that the code is running as you expected.

Ready To Get Started?

Visit our contact us page and fill out the form or give us a call at 1.866.759.6546. We will be happy to discuss our coding services in more detail with you. Just keep in mind, coding a trading system can be accompanied with either great joy or tremendous disappointment. We will code your idea and deliver the code, however there are no guarantees that your idea will be a reliable trading strategy. Designing and developing trading systems is not an easy task. Once an idea is implemented and back-tested, the results may or may not represent a profitable trading strategy. Trading futures & options involves substantial risk of loss and is not appropriate for all investors.