THE NOBLE TRADING SYSTEM

Past performance is not indicative of future performance. Trading futures & options is not for everyone and involves substantial risk of loss.

PRODUCT DASHBOARD: NOBLE TRADING SYSTEM

The following information was taken from walk-forward trades in the sim account. While performing your due diligence, keep in mind that we are not registered Commodity Trading Advisers (CTA) and therefore this data has not been reviewed by any government agency such as the CFTC. These results include per trade commission charged by the broker, however they do not take into account the license fee AlgorithmicTrading.net charges for the use of their algorithms.

PRODUCT DASHBOARD: NOBLE TRADING SYSTEM

The following information was taken from walk-forward results seen in the tradestation sim account.

| Walk-Forward Performance Analysis (per UNIT traded) | |

| Per Unit Trade Size | $40,000 |

| Annual % Rate of Return | +66.62% |

| Monthly % Rate of Return | +5.59% |

| Average $ Gain/Mo | +$2,062 Per Unit Traded |

| Total # Trades | 5564 |

| Period Back-Tested * | Jan 1995 – Dec 2009 |

| Period Walk-Forward-Tested* | Jan 2010 – Nov 2022 |

| Period Live | Nov 2022 – Present |

| Per Trade Win Rate | 64.54% |

| Slippage/Commission Used in Analysis | |

| Commission used in all reports (Futures Trade) | $6.50 per round trip trade (all-in) |

| Commission used in all reports (Options Trade) | $14.48 per round trip spread (all-in) |

| Draw-Down (per UNIT traded) | |

| Worst % draw-down (closing trade to closing trade) | -34.78%* |

| Period Seen | March 2010 – July 2010 |

| Account Details | |

| Trades Futures | Yes |

| Types of Futures Trades | Day Trade Long/Short |

| Trades Options | Yes |

| Types of Options Trades | Sells ES Put Spreads |

| Account types allowed | Cash, IRA, Roth IRA |

| Licenses available | Yes |

| Licensing fee | Contact Us for Pricing |

*Estimated closing trade to closing trade draw-down based on back-tested period (see CFTC disclaimer, below). Note that heavier losses than indicated are possible. Maximum Draw down can be used to determine the measure of risk involved with any given trading system. It represents the maximum peak to valley loss seen on the account during the back-tested period.

U.S. Government Required Disclaimer – Commodity Futures, Trading Commission Futures, Derivatives and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This website is neither a solicitation nor an offer to Buy/Sell futures, options, or any other assets. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41: Results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

OPTIONS DISCLAIMER: Back testing an options algorithm poses many challenges due to the unknown estimates for premium collected. Option premiums can vary greatly and are dependent on many different factors, including but not limited to, market volatility and time until expiration – making it impossible to know specific premiums of the options involved in the back-tested data at the time of the trades in question. In addition, the daily options were not available to trade for the entire back-tested period. In order to provide our customers with the most accurate back-tested performance results that we can, we have created a look-up-table to model the profit/loss for past options trade. Please note, these estimates have significant limitations and the corresponding reports which use these estimates should be considered to be much less than perfect. All back-testing has limitations, however back-tested options algorithms have even more in our opinion due to the potential inaccuracies used in determining premium collected estimates.

OPTIONS ALGORITHM EXAMPLE

The following video shows an options trade that occurred on Noble & Paladin. This video was recorded live on Friday 12/2/2022. This video highlights how powerful the options algorithm is. Notice how it correctly identified that the market would close higher, with remarkable accuracy.

The past performance of any trading system or methodology is not necessarily indicative of future results. Trading futures involves substantial risk of loss and is not appropriate for all investors.

EMERALD DAY TRADE SHORT EXAMPLE

The following video shows an amazing short trade that we had on Monday 12/5/2022. You also see three options trades occur on the same day (Noble took the first two + the day trade short). Overall, market was down but we were positive.

The past performance of any trading system or methodology is not necessarily indicative of future results. Trading futures involves substantial risk of loss and is not appropriate for all investors.

THE NOBLE TRADING SYSTEM FEATURES

UTILIZES EMERALD STRATEGIES

Trades our newest trading strategies, the emerald day trade long, short and options strategies.

100% AUTOMATED SYSTEM

TRADES IN BULL & BEAR MARKETS

POSITIVE ONLINE REPUTATION

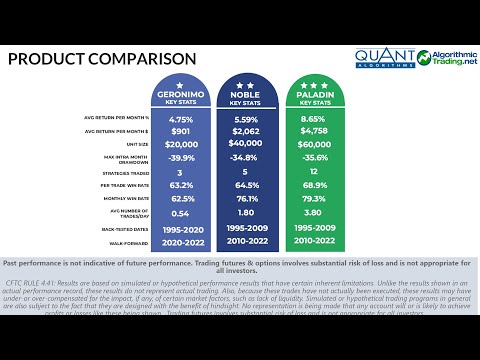

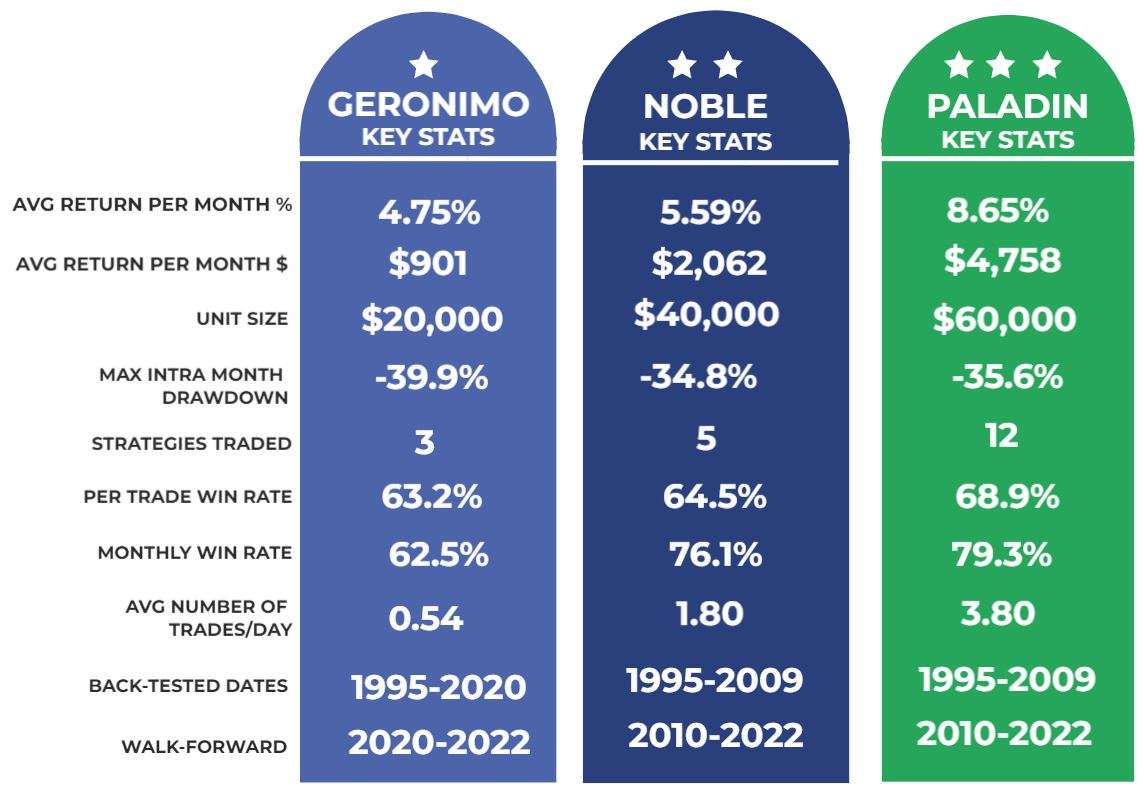

HOW DOES THE NOBLE TRADING SYSTEM STACK UP?

The past performance of any trading system or methodology is not necessarily indicative of future results. Trading futures involves substantial risk of loss and is not appropriate for all investors.

CFTC RULE 4.41: Results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

Why would anyone prefer to use this algorithm over the others?

This trading systems is provided for customers who have a mid-sized account of approximately $40,000. If someone has $20,000 or less, then they should consider using the Geronimo Trading system. If someone has $60,000 or more, they should consider using the Paladin Trading System.

Please note, both Paladin & Noble have an added degree of uncertainty due to the limitations of back-testing an options algorithm. See the options disclaimer on the tear sheet for more details.

Could I start with Noble and trade Geronimo as well?

Yes. You could begin trading the noble trading system and then move to Geronimo at no extra charge, as long as you are trading within the total dollar amount you agreed to.

What strategies are traded within Noble?

This trading systems trades five different algorithms. It utilizes the day trade long, emerald day trading strategies long and short, along with 2 options strategies.

Is this fully automated?

Yes, just like the other systems we offer, this is a fully automated trading system. It auto-trades under a letter of direction by NFA registered brokers.

STRATEGIES TRADED WITHIN NOBLE

Noble trades a total of 5 different strategies. The following pictures show an example of each kind of trade, Noble can place. This strategy trades five different strategies and is our mid-range product, having a unit size of $40,000. As you review the trade data, please keep in mind CFTC Rule 4.41 as it pertains to the limitations of hypothetical returns.

Emerald Day Trade Short Strategy

The Emerald Day Trade Short Strategy places a short trade on the Emini-S&P Futures at various times throughout the day. It utilizes a larger “short-covering” stop and can hold the entire day or exit early based on the predictive exit logic. The short strategy will place certain trades, when the market state prediction logic suggests that the market will be in a strong downward moving market (strong down). If it sees evidence that it might be wrong, based on market conditions, it will exit prematurely with either a gain or a loss. Otherwise, it will hold until the close and exit at 4PM EST.

This trading algorithm is used in the Noble & Paladin Trading Systems.

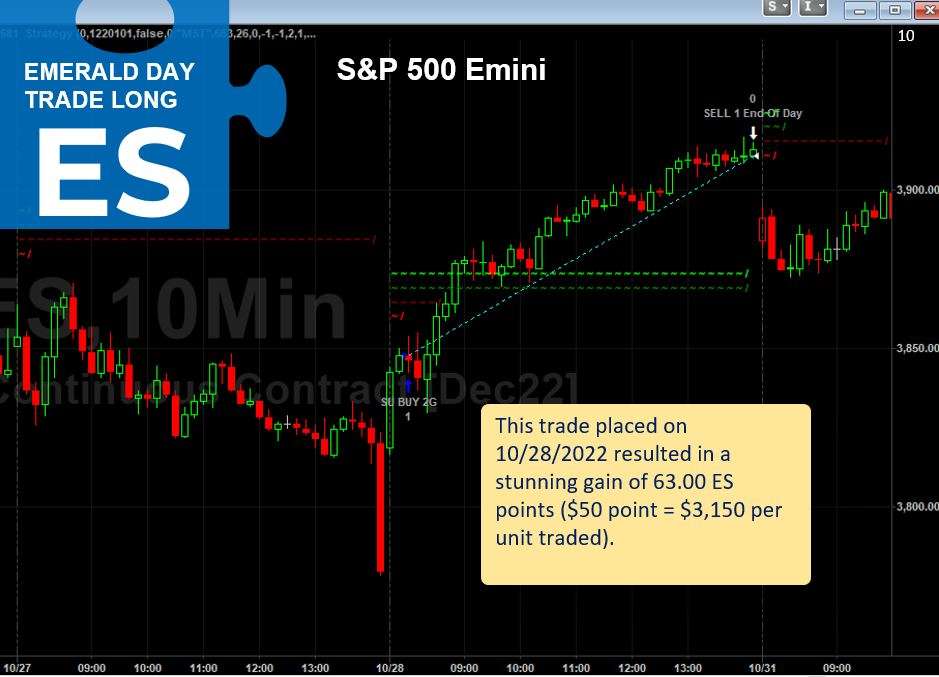

Emerald Day Trade Long Strategy

The Emerald Day Trade Long Strategy places a long trade on the Emini-S&P Futures at various times throughout the day. It utilizes a larger “crash” stop and can hold the entire day or exit early based on the predictive exit logic. The long strategy will place certain trades, when the market state prediction logic suggests that the market will be in a strongly upward moving market (strong up). If it sees evidence that it might be wrong, based on market conditions, it will exit prematurely with either a gain or a loss. Otherwise, it will hold until the close and exit at 4PM EST.

This trading algorithm is used in the Noble & Paladin Trading Systems.

Day Trade Long (Breakout) Algorithm

The Breakout Day Trading Strategy places day trades on the Emini-S&P Futures when the market shows strength in the morning. It utilizes a very tight stop while trying to maximize the gains seen on winning trades.

Here’s a video recording of a day trade short that triggered on 13 May 2022. This trade resulted in a gain of approximately $2,295 per unit traded. Just remember, past performance is not indicative of future performance.

This strategy is traded in all three trading systems we offer (Geronimo, Noble & Paladin).

Options Day Trading Algorithm (1 & 2)

This algorithm uses a proprietary walk-forward analysis, that will analyze the current day and compare it to every single other day in the back-test. At that point, it will decide if the market will close higher or lower than the current price. If a certain threshold is met, it will sell a 20-25 point put spread, that will expire the same day (making this a day trade). Once a trade is entered, it will hold until the close of the market, when the options will expire with either a max profit (options expire above the short strike), partial profit/loss (options expire between short/long strike) or a max loss (options expire below both the long strike).

This trading algorithm is used in the Noble & Paladin Trading Systems. In the Noble Trading System, it will take the first 2 generated trades, while in Paladin it will take the first 8 trades generated.

The past performance of any trading system or methodology is not necessarily indicative of future results. Trading futures involves substantial risk of loss and is not appropriate for all investors.

CFTC RULE 4.41: Results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

KEEP UP TO DATE ON ALL TRADES

Using the OEC iBroker app you are able to receive push notifications when we get into a new trade, see limit and stop market orders, charts of the S&P Emini and Ten Year Note, plus current account balance and much more. Select brokers utilize the OEC iBroker App (iPhone and Android), ask us for more details.

Start Auto-Trading Today With The Noble Trading System