This is the second video in a two part series that was examining, what separates Algorithmic Trading Strategies from other types of trading. In the first video, we looked at a MACD Trading Strategy that utilized a bullish cross to enter into the trade. In this second video, we look at the next level of this strategy as recommended on the website suggesting this strategy. This refined strategy called for a confirmation using the Awesome Oscillator (AO). Similar to the first video blog in this series, the Awesome Oscillator + MACD Bullish Cross is coded up – using a finite state machine. Next, an in depth analysis is done on this strategy using quantitative analysis. Does the author have a winning strategy? Read on to see how this Awesome Oscillator Swing Trading Strategy performs after applying some basic quant trading analysis.

Awesome Oscillator Swing Trading Strategy Rules

Here is a snap shot of what was recommended, taken directly from the website that recommended this strategy:

The author goes on to say the following in his final recommendation section:

NOTE: This is not an AlgorithmicTrading.net recommendation, but the recommendation from another site explaining how to use the Awesome Oscillator. The purpose of this video, was to determine if it is in fact – a good trading strategy.

Awesome Oscillator Swing Trading Strategy Implementation

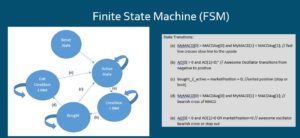

Because this trading strategy is looking for a sequence of events, both to get in and to get out of the trade, I decided to use a Finite State Machine to implement the core of this trading algorithm.

The strategy mentioned on the website had the exit criteria defined as a bullish cross of the MACD + a confirmation by the Awesome Oscillator. In order to fully vet this trading system, I added various other inputs such that we could test multiple scenarios using the Awesome Oscillator Example.

Awesome Oscillator Swing Trading Strategy Initial Analysis

The initial analysis of this strategy showed some potential. The strategy was profitable on a first pass – but was it profitable enough to have us continue our evaluation and perform some walk-forward simulations?

Awesome Oscillator Swing Trading Strategy Final Analysis

Curious how this strategy did during the entire back-tested period? What happens if you add a limit order to the exit criteria? What if you add a stop market order and do an exhaustive back-test looking at multiple combinations of Stop Market and Limit Orders. What if we modify the initial settings for the Awesome Oscillator – fast length and slow length. Watch the complete video for answers to these questions an more.

Thanks for watching! Remember, trading futures & options involves substantial risk of loss and is not appropriate for all investors.