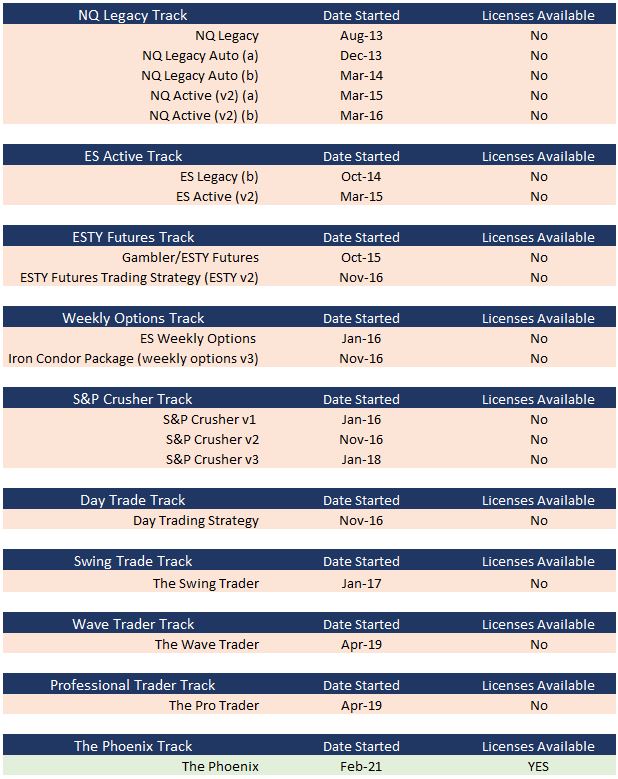

History of Algorithmic Trading

This data following this table shows the progression of our product offerings and is being shared in the spirit of full-disclosure/transparency so that potential clients can see the other algorithmic trading systems we have offered prior to our current offerings.

Past performance is not indicative of future performance. Trading futures involves substantial risk of loss and is not appropriate for all investors.

History of Each Package

The following graphics show the history of changes for packages both currently and previously offered.

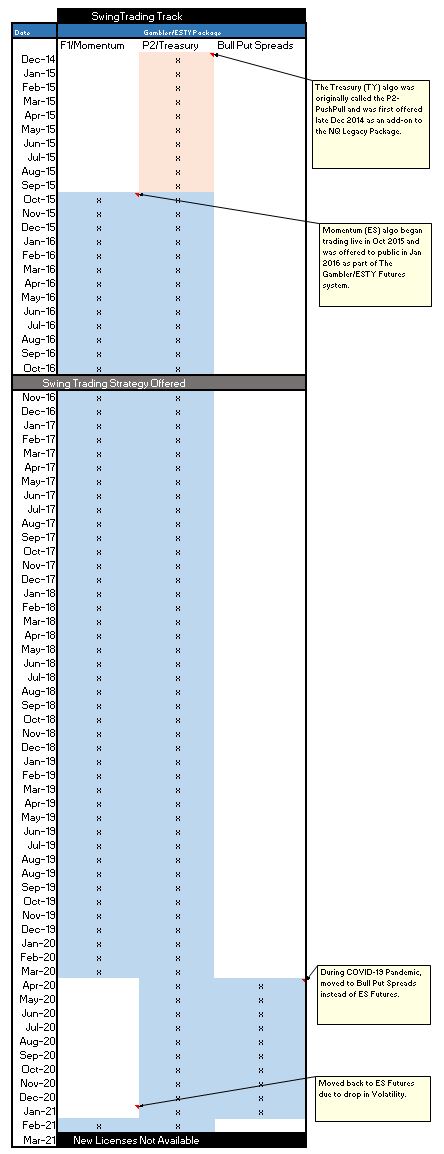

The Swing Trader Track History – New Licenses Not Available

The following picture shows the key upgrades made to this package. This trading system was created by combining our two best-performing algorithms as of October 2016. The Swing Trader trades the Momentum ES Algo and the Treasury Note TY Algo, both of which can handle a substantial amount of trading volume. The Treasury Note TY Algo (formerly called the P2-PushPull) was developed in Nov 2014-Dec 2014 with the last optimization being performed in December 2014. It was offered to our NQ Legacy Customers as an add-on to the NQ Legacy package to help generate alpha during sustained bear markets. The Momentum ES Algo was last optimized around Oct 2015 and began trading live at that time. Together, these two algorithms represent our most popular swing trading system called The Swing Trader.

Bull Put Spreads (April 2020)

During the COVID-19 Pandemic, the Swing Trader began utilizing Bullish Put Spreads instead of the Momentum ES Futures Trades. This strategy was employed between April 2020 – January 2021 with success during the initial months. In January 2021, it became clear that the futures trades were superior to the Bull Put Spreads and so the program moved back to the futures at the end of January 2021. In February of 2021, the futures had their own drawdown and combined this caused larger than normal losses on individual’s accounts. The decision was made at that point, to revert back to the Futures trades and to stop offering the Swing Trader to new clients. As of now, the swing trader is still traded by clients of AlgorithmicTrading.net, both the Futures version and the Bull Put Spread version.

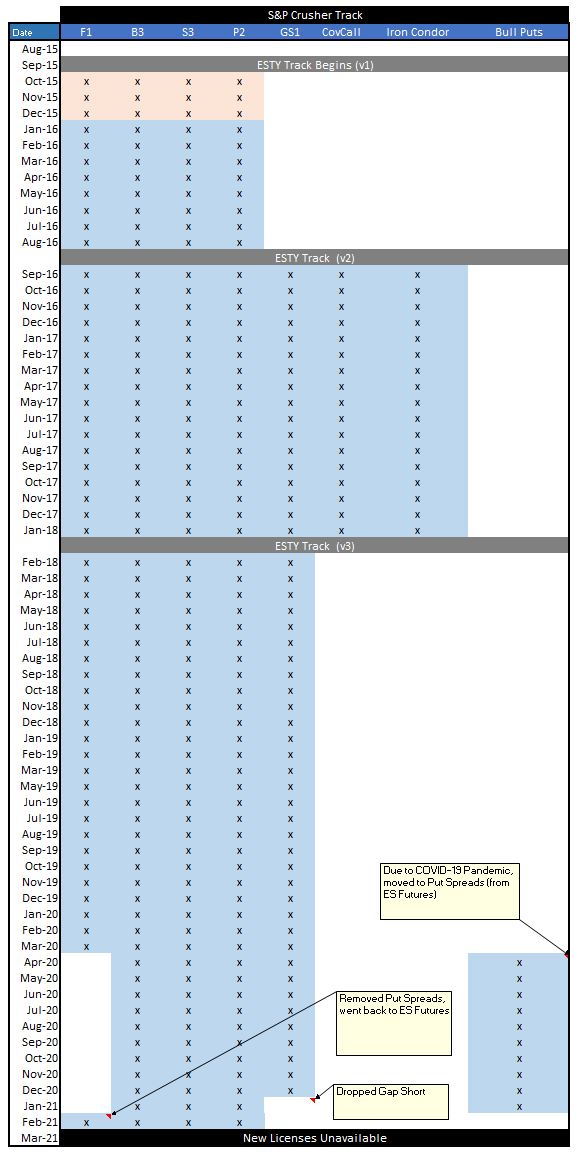

S&P Crusher Track History – New Licenses Not Available

The following picture shows the key upgrades made to this package over the last few years. The most recent change to this package was to remove the Spread Trades and go back to the ES Futures (Momentum ES). Visit the S&P Crusher Portfolio page for more information on this package.

Bull Put Spreads (April 2020)

During the COVID-19 Pandemic, the S&P Crusher began utilizing Bullish Put Spreads instead of the Momentum ES Futures Trades. This strategy was employed between April 2020 – January 2021 with success during the initial months. In January 2021, it became clear that the futures trades were superior to the Bull Put Spreads and so the program moved back to the futures at the end of January 2021. In addition, the Gap Short algorithm was pulled from the S&P Crusher due to lackluster performance. In February of 2021, the futures had their own drawdown and combined this caused larger than normal losses on individual’s accounts. The decision was made at that point, to revert back to the Futures trades and to stop offering the S&P Crusher to new clients. As of now, the S&P Crusher is still traded by clients of AlgorithmicTrading.net, both the Futures version and the Bull Put Spread version.

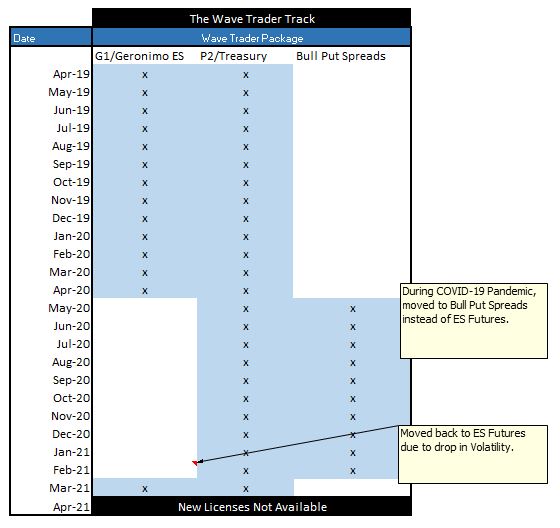

The Wave-Trader Track History – New Licenses Not Available

The following picture shows the key upgrades made to this package over the last few years. This package was launched to new clients in 2019 with great success. It trades the Momentum TY algorithm and the Geronimo ES Algo.

Bull Put Spreads (April 2020)

During the COVID-19 Pandemic, The Wave-Trader began utilizing Bullish Put Spreads instead of the Geronimo ES Futures Trades. This strategy was employed between April 2020 – January 2021 with success during the initial months. In January 2021, it became clear that the futures trades were superior to the Bull Put Spreads and so the program moved back to the futures at the end of January 2021. Following the negative performance in January 2021, the decision was made to revert back to the Futures trades and to stop offering the Wave-Trader to new clients. As of now, Wave Trader is still traded by clients of AlgorithmicTrading.net, both the Futures version and the Bull Put Spread version.

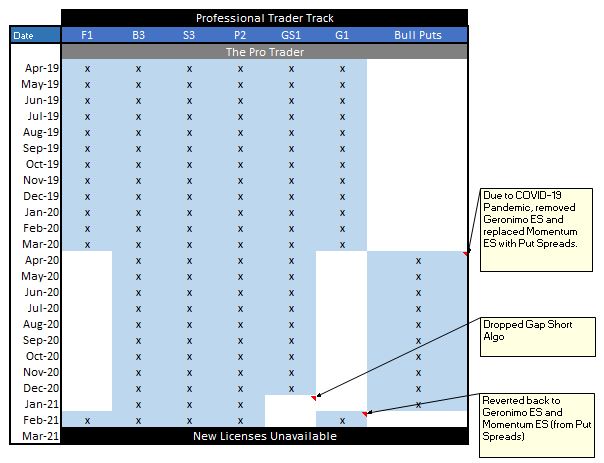

The Professional Trader Track History – New Licenses Not Available

The following picture shows the key upgrades made to this package over the last few years. This package was launched to new clients in 2019 with great success. It traded six total algorithms, including the Momentum TY algorithm, Momentum ES, Geronimo ES , Day Trade Long, Day Trade Short, and Gap Short Algos.

Bull Put Spreads (April 2020)

During the COVID-19 Pandemic, The Pro-Trader began utilizing Bullish Put Spreads instead of the Momentum ES Futures Trades. During this period, it also dropped the Geronimo ES algorithm due to increased volatility. The Bull Put Version of this strategy was employed between April 2020 – January 2021 with success during the initial months. In January 2021, it became clear that the futures trades were superior to the Bull Put Spreads and so the program moved back to the futures at the end of January 2021. Like the S&P Crusher, it also dropped the Gap Short algorithm due to poor performance. Following the negative performance in January 2021, the decision was made to revert back to the Futures trades and to stop offering the Pro-Trader to new clients. As of now, Pro Trader is still traded by clients of AlgorithmicTrading.net, both the Futures version and the Bull Put Spread version.

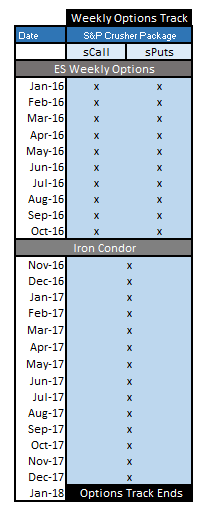

Weekly Options Track History – Not Offered As of January 2018

The following picture shows the key upgrades made to the weekly options trading system. As of January 2018, this options trading system is not being offered.

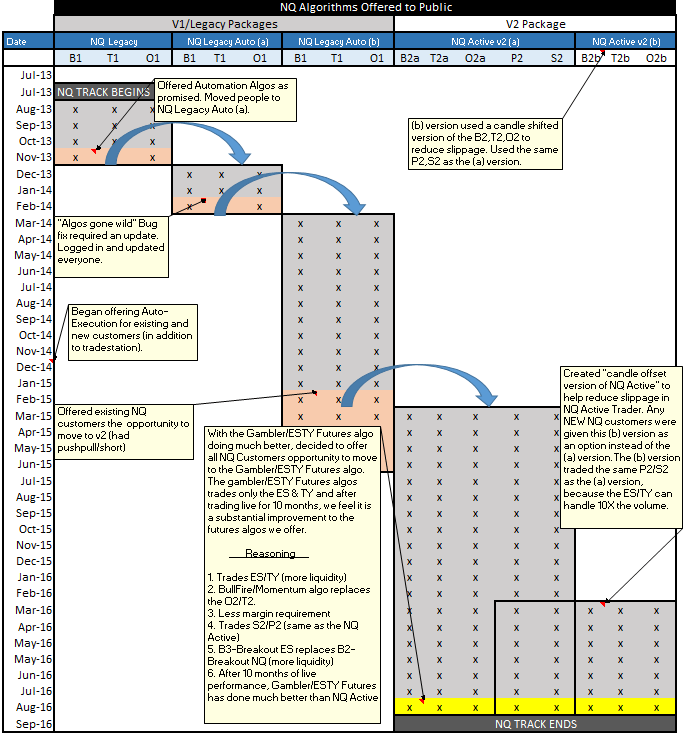

NQ Legacy Track History – Licenses Not Available As Of September 2016

Trading futures & options involves substantial risk of loss & is not appropriate for all investors.

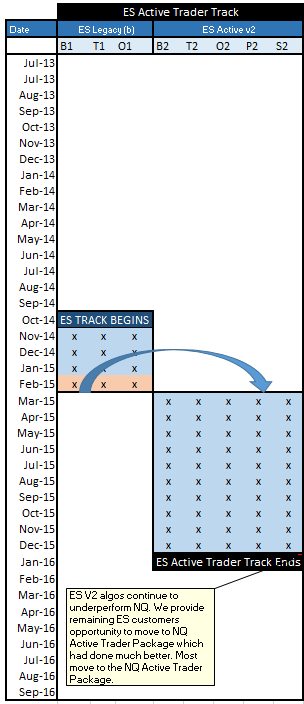

ES Track History – Not Offered as of January 2016

The following picture is our attempt to capture the ES Active Trader Track of algorithms (starting with the ES Active Trader (b), then finally the ES Active Trader (v2). If you have any questions on the following data – please ask us, we would be happy to walk you through this data. The intent is to show the key upgrades which were made, as well as how the majority of our customers transitioned during these upgrades.