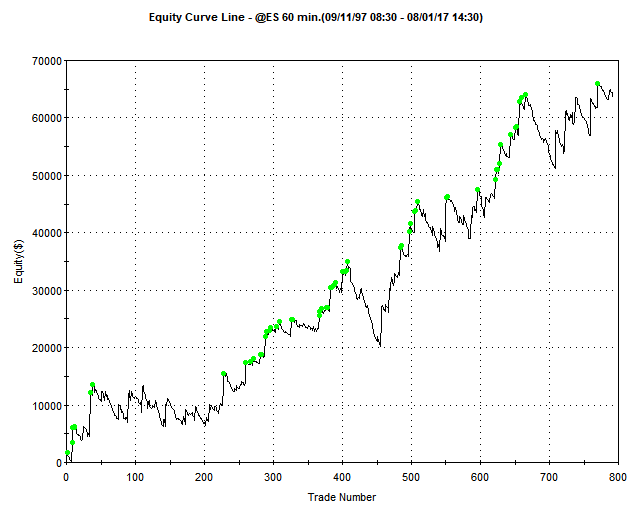

Moving Average Price Crossing Trading Strategy: ES Shorter Term Swing Trade

Applying the Moving Average Price Crossing strategy on the ES with 60 Minute CandlesMoving Average Price Crossover System: Market Index (ES)

Trade Entry/Exit Rules

Stop Settings:

No Stop Used

Limit Settings:

No Limit (target) Used

Buy Trigger(s):

New Close Above Moving Average

Sell Trigger(s):

New Close Below Moving Average

LONG Entry Results: Swing Trade (shorter term)

| Simulation Setting | |

| Asset Type | Futures |

| Symbol | @ES |

| Start Date | 11/11/1997 |

| End Date | 08/01/2017 |

| Trading Session Time | 930EST to 1610EST |

| Trading Application | Swing Trade (shorter term) |

| Candle Size | 60.00 Minutes |

| Direction | Long |

| Moving Average Type | EMA |

| Moving Average Length | 110 |

| Performance Metric | |

| Profit Factor | 1.34 |

| Net Profit ($) | $63635.00 |

| Gross Profit ($) | $251000.00 |

| Gross Loss ($) | $-187365.00 |

| Total Trades | 793 |

| Average Gain/Trade | $80.25 Per Trade |

| Percent Profitable | 27.11% |

| Maximum Drawdown | $-15202.50 |

Trading Strategy Analysis

This application shows much more promise than some of the others analyzed using the Moving Average Price Crossover strategy. A few metrics stick out as positives. First, there are a larger number of trades. Second, the profit factor is good enough. Third, the average gain per trade is better. The only issue on a first pass with this strategy is that the Maximum Drawdown is still fairly large. It should be noted however, that it is still better than the Buy & Hold version of this strategy – meaning this setup outperforms the market.

Of all the combinations examined using this strategy – the Shorter Term Swing Trade (market index: ES) is the best case.