Moving Average Price Crossing Trading Strategy: INTC Day Trade

Applying the Moving Average Price Crossing strategy to INTC with 10 Minute CandlesMoving Average Price Crossover System: Equities (INTC)

Trade Entry/Exit Rules

Stop Settings:

No Stop Used

Limit Settings:

No Limit (target) Used

Buy Trigger(s):

New Close Above Moving Average

Sell Trigger(s):

New Close Below Moving Average OR Market Closes

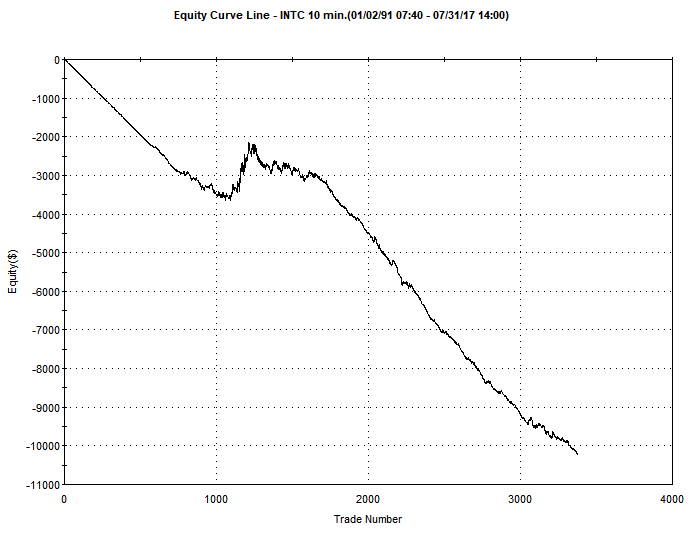

LONG Entry Results: Day Trade

| Simulation Setting | |

| Asset Type | Equities |

| Symbol | INTC |

| Start Date | 03/06/1991 |

| End Date | 07/31/2017 |

| Trading Session Time | 930EST to 1600EST |

| Trading Application | Day Trade |

| Candle Size | 10 Minutes |

| Direction | Long |

| Moving Average Type | SMA |

| Moving Average Length | 300 |

| Performance Metric | |

| Profit Factor | 0.64 |

| Net Profit ($) | $-10209.00 |

| Gross Profit ($) | $17899.00 |

| Gross Loss ($) | $-28108.00 |

| Total Trades | 3376 |

| Average Gain/Trade | $-3.02 Per Trade |

| Percent Profitable | 20.17% |

| Maximum Drawdown | $-10220.00 |

Trading Strategy Analysis

As the equity curve shows, this strategy is about as bad as it gets. Straight down with very few gains. The final optimization showed a Moving Average length of 300 was ideal – which implies that this strategy should NEVER be applied to a stock such as INTC. Of course, this equity curve does beg the question: “What if we instead went short when a new signal was generated?”.

[addtoany]