THE TRADER PLUS TRADING SYSTEM

Past performance is not indicative of future performance. Trading futures & options is not for everyone and involves substantial risk of loss.

PRODUCT DASHBOARD: TRADER PLUS TRADING SYSTEM

The following information was taken from back-tested reports derived from TradeStation. While performing your due diligence, keep in mind that we are not registered Commodity Trading Advisers (CTA) and therefore this data has not been reviewed by any government agency such as the CFTC. These results include per trade commission charged by the broker, however they do not take into account the license fee AlgorithmicTrading.net charges for the use of their algorithms.

PRODUCT DASHBOARD: TRADER PLUS TRADING SYSTEM

The following information was taken from back-tested results seen in the TradeStation sim account.

| Back-Tested Performance Analysis (per UNIT traded) | |

| Per Unit Trade Size | $25,000 |

| Annual % Rate of Return | +66.34% |

| Monthly % Rate of Return | +5.53% |

| Average $ Gain/Mo | +$1,382 Per Unit Traded |

| Total # Trades | 945 |

| Period Back-Tested | Jan 2017- Mar 2023 |

| Full Back-Test Period | Jan 1995- Mar 2023 |

| Period Live | Mar 2023 – Present |

| % Profitable Months | 70.67% |

| Commission Used in Analysis | |

| Commission used in all reports (Futures Trade) | $6.50 per round trip trade (all-in) |

| Draw-Down (per UNIT traded) | |

| Worst % draw-down (closing month to closing month) | -22.3%* |

| Period Seen | Jan 2022 |

| Account Details | |

| Trades Futures | Yes |

| Types of Futures Trades | Day Trade Long/Short |

| Trades Options | No |

| Account types allowed | Cash, IRA, Roth IRA |

| Licenses available | Yes |

| Licensing fee | Contact Us for Pricing |

*Estimated closing month to closing month draw-down based on back-tested period (see CFTC disclaimer, below). Note that heavier losses than indicated are possible. Maximum Draw down can be used to determine the measure of risk involved with any given trading system. It represents the maximum peak to valley loss (closing month to closing month) seen on the account during the back-tested period.

U.S. Government Required Disclaimer – Commodity Futures, Trading Commission Futures, Derivatives and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This website is neither a solicitation nor an offer to Buy/Sell futures, options, or any other assets. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41: Results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

BACK-TESTED REPORTS: TRADER PLUS

This back-tested report combines the three individual reports you see listed below, into a single report, which represents the complete Trader Plus back-tested report. You will find a lot of information listed to include a performance summary, equity graphs, periodic returns, drawdown graphs, correlations along with a full trade list. Just remember CFTC Rule 4.41 as it pertains to back-tested reports.

Individual Strategy Reports

The Trader Plus trading system trades three individual trading strategies. You can find each individual strategy contained within the Trader Plus here. These individual strategies are capable of trading alone, however they are meant to be combined into a trading system, such as The Trader Plus, in order to diversify and smooth out the equity curve.

CFTC RULE 4.41: Results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

THE TRADER PLUS TRADING SYSTEM FEATURES

UTILIZES THREE DIFFERENT STRATEGIES

Trades a total of three day-trade strategies which are designed to take advantage of market inefficiencies will attempting to reduce risk (does not hold overnight).

100% AUTOMATED SYSTEM

The Elite Trader is a fully automated futures trading system, with zero time commitment required. Receive real-time trade alerts on your phone, and daily statements.

TRADES IN BULL & BEAR MARKETS

It is impossible to predict market direction with 100% certainty. Our methodology is to acknowledge this fact and trade multiple uncorrelated strategies that all trade the S&P Emini’s to take advantage of both market conditions.

POSITIVE ONLINE REPUTATION

Our company has been around since February 2014 and our online reputation is quite impressive. But don’t take our word for it. We are A+ Rated on the BBB, RipOffReport Verified, certified trades our own system and have appeared in various podcasts, print magazines and online blogs.

HOW DOES THE TRADER PLUS TRADING SYSTEM STACK UP?

This system uses three different day-trading strategies to increase performance by diversifying across multiple time frames and multiple indicators.

The past performance of any trading system or methodology is not necessarily indicative of future results. Trading futures involves substantial risk of loss and is not appropriate for all investors.

CFTC RULE 4.41: Results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

Why would anyone prefer to use this algorithm over the others?

The Trader Plus trading system allows for a smaller account size to get started. Since it trades three day-trade strategies, the recommended unit size is only $25,000. If someone has $35,000 or more, they should strongly consider using The Elite Trader instead of the Trader Plus.

How long has this strategy been around?

The strategies employed in the Trader Plus Trading System have been around for various degrees of time. The Day Trade Long has traded live since 2017, however the v2 change was made in early 2023 and simply adds a target and trailing stop. The other two algorithms (Emerald Long, Emerald Short) were developed in 2022 and began live trading in November of 2022.

What strategies are traded within the Trader Plus trading system?

This trading systems trades 3 different algorithms. It utilizes the day trade long (v2), emerald day trade long and emerald day trade short.

Is this fully automated?

Yes, just like the other systems we offer, this is a fully automated trading system. It auto-trades under a letter of direction by NFA registered brokers.

STRATEGIES TRADED WITHIN TRADER PLUS

Trader Plus uses a total of 3 different strategies. The following pictures show an example of each kind of trade, this algo can place. As you review the trade data, please keep in mind CFTC Rule 4.41 as it pertains to the limitations of hypothetical returns.

Day Trade Trading Strategy

The Day Trade strategy places day trades on the Emini-S&P Futures when the market shows strength in the morning. It utilizes a very tight stop while trying to maximize the gains seen on winning trades. The v2 version of the Day Trade algorithm employs a trailing stop & profit target. The following video shows a Day Trade that triggered resulting in a gain of approximately $2,300 per unit traded.

This strategy is traded in all three ES trading systems we offer (Basic Trader, Trader Plus and Elite Trader).

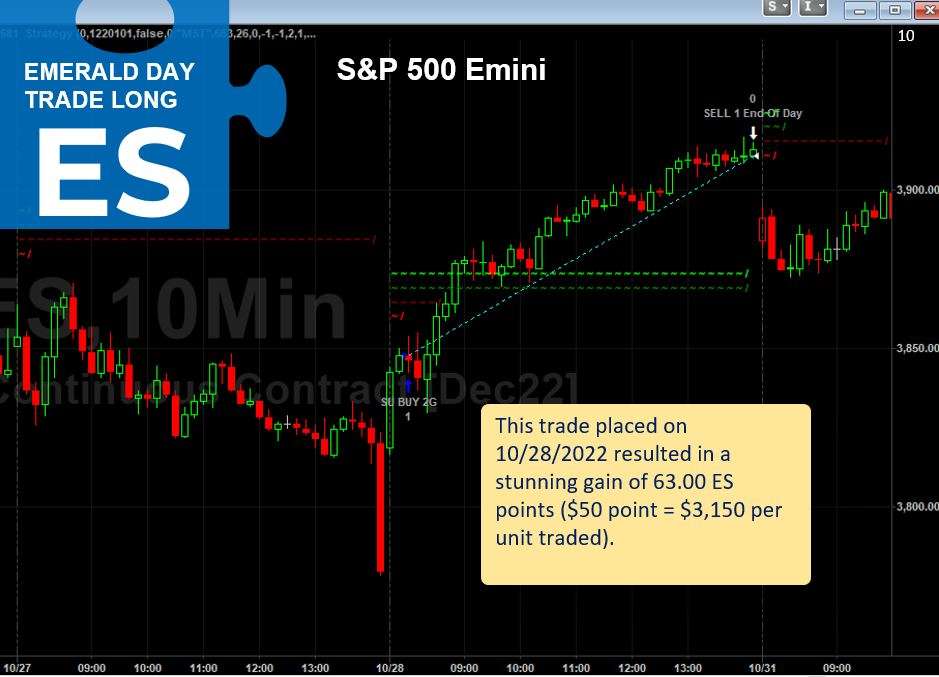

Emerald Day Trade Long Strategy

The Emerald Day Trade Long Strategy places a long trade on the Emini-S&P Futures at various times throughout the day. It utilizes a larger “crash” stop and can hold the entire day or exit early based on the predictive exit logic. The long strategy will place certain trades, when the market state prediction logic suggests that the market will be in a strongly upward moving market (strong up). If it sees evidence that it might be wrong, based on market conditions, it will exit prematurely with either a gain or a loss. Otherwise, it will hold until the close and exit at 4PM EST.

This trading algorithm is used in the Trader Plus and Elite Trading Systems.

Emerald Day Trade Short Strategy

The Emerald Day Trade Short Strategy places a short trade on the Emini-S&P Futures at various times throughout the day. It utilizes a larger “short-covering” stop and can hold the entire day or exit early based on the predictive exit logic. The short strategy will place certain trades, when the market state prediction logic suggests that the market will be in a strong downward moving market (strong down). If it sees evidence that it might be wrong, based on market conditions, it will exit prematurely with either a gain or a loss. Otherwise, it will hold until the close and exit at 4PM EST.

This trading algorithm is used in the Trader Plus and Elite Trading Systems.

The past performance of any trading system or methodology is not necessarily indicative of future results. Trading futures involves substantial risk of loss and is not appropriate for all investors.

CFTC RULE 4.41: Results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

KEEP UP TO DATE ON ALL TRADES

Using the OEC iBroker app you are able to receive push notifications when we get into a new trade, see limit and stop market orders, charts of the S&P Emini, plus current account balance and much more. Select brokers utilize the OEC iBroker App (iPhone and Android), ask us for more details.

STEPS ON GETTING STARTED

-

PICK A TRADING SYSTEM

Setup a time to discuss which system you would like to trade. During this time, we will answer any questions you might have including the pricing and provide you with a list of brokers supported. Once you have decided on a system, we will send you a sales order along with the payment instructions.

-

OPEN & FUND TRADING ACCOUNT

Once you decide on the system and how much you prefer to trade, we will send you a license agreement electronically. We will also introduce you to the NFA Registered Broker you decided to use. They will help you open & fund the trading account.

-

BEGIN TRADING

The Algorithms will begin trading. You will be able to follow along in real time on your Smart Phone (iPhone or Android). You will also receive daily statements from the broker.

Start Auto-Trading Today With The Trader Plus Trading System